Basics

- The Accounting Companies page is found in the Church Structure folder.

- Most churches should only ever have one Accounting Company record. This one record is created during implementation and discussed with your Think Ministry Trainer and/or Coach when setting up your system.

- Sometimes additional Accounting Company records are appropriate. But additional Accounting Company records should only exist when a church is engaged in supporting a church plant or is running an integrated auxiliary that has separate books from the church.

- But even if more than one Accounting Company record does exist, donations and registration payments can only be designated to one Accounting Company. They can not be split between Accounting Companies. It's also important to note that getting aggregated data across multiple Accounting Companies is tricky, as many of the finance-related reports require you to select only one Accounting Company at a time

Impact on Other Parts of the Platform

The following items depend upon the Accounting Company record:

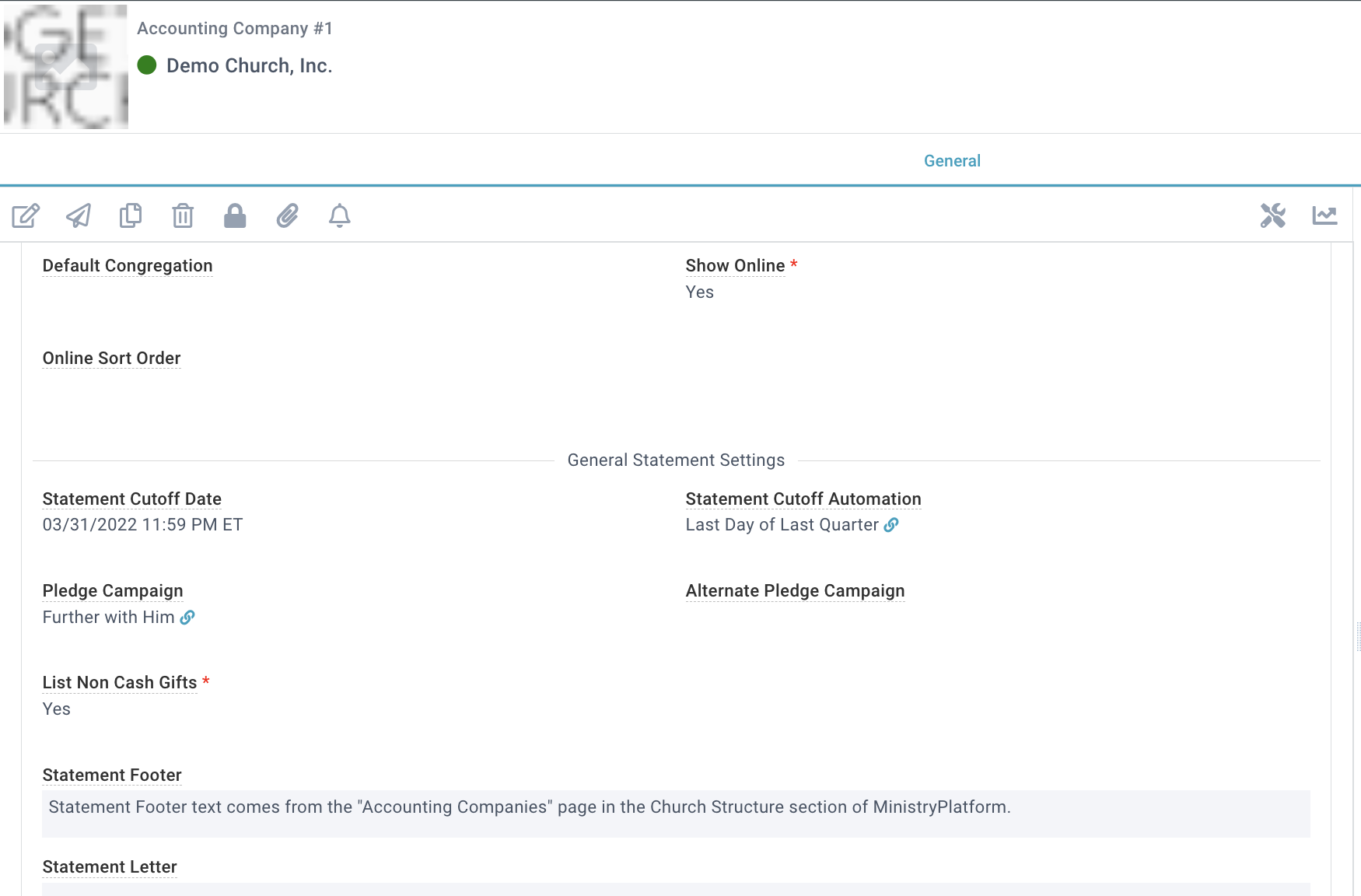

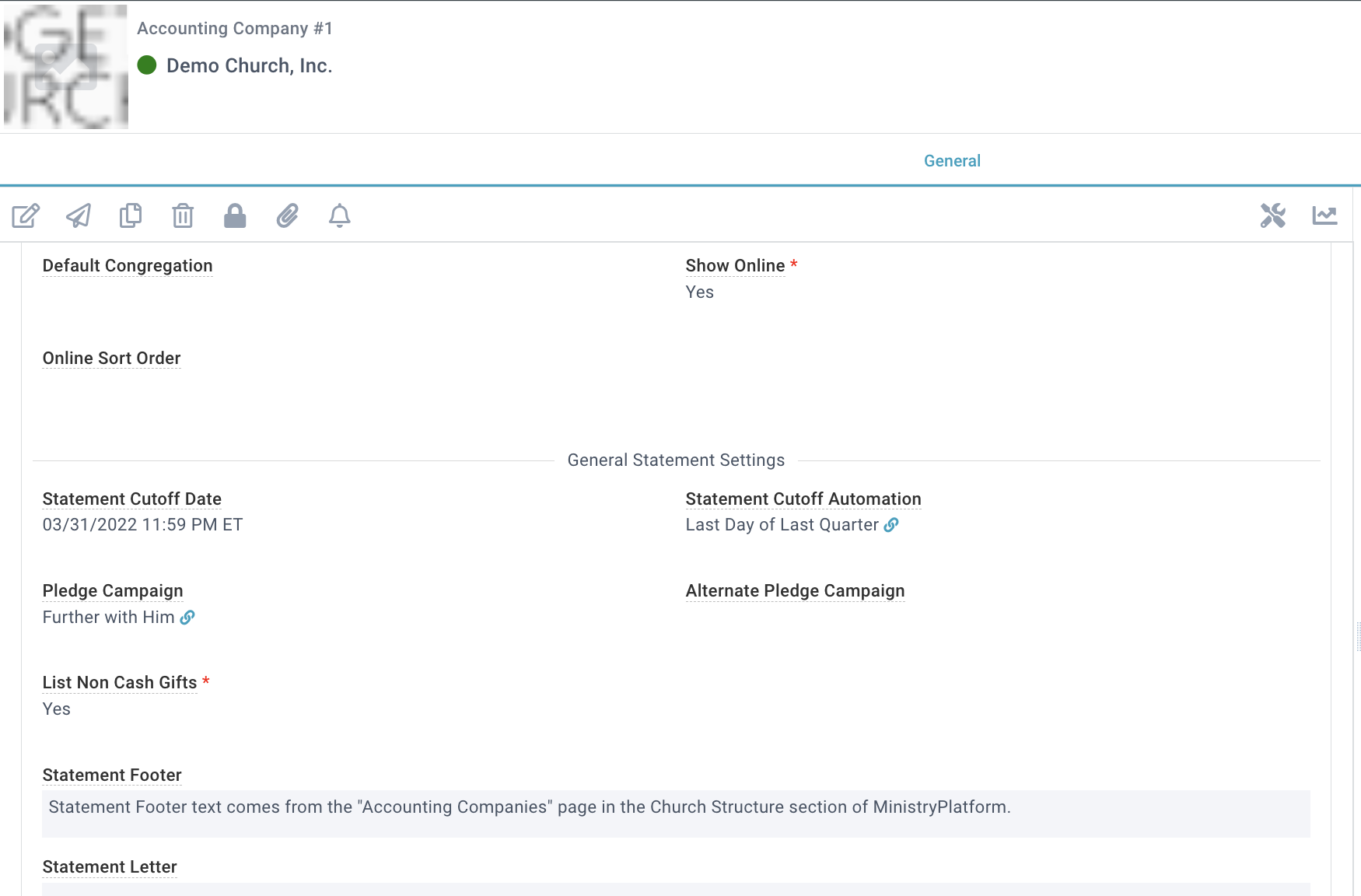

The Accounting Company Statement Cutoff Date is a date/time field used when generating all statements for the Accounting Company, including those available on the My Contribution Statement page and Standard Statements. Standard Statements considers both the date and time when determining the statement cutoff date. Want to include all donations made through December 31? Set the Statement Cutoff Date to 12/31/[year] 11:59pm. Creating a New Accounting Company

When creating a new Accounting Company:

- Use the Add a Company Tool to define the name, email, phone, and address of the company.

- Go to Church Structure > Accounting Companies > New to create a new record. Indicate the company you made in Step #1 in the Company Contact field.

- Go to Church Structure > Congregations and ensure at least one Congregation has the Accounting Company you made in Step #2 in the Accounting Company field.

- Go to Church Structure > Programs to create at least one Program for Events and Donations and assign it to that Congregation and Ministry.